- Cash and checks are declining but not disappearing.

- Debit, credit, and prepaid cards will compete for growing digital spending.

- FedNow’s launch could increase the prominence of bank-based payments and intensify competition.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

Although debit still reigns supreme, with consumer preferences moving toward digital, cash and checks will continue to be displaced in the US.

Insider Intelligence

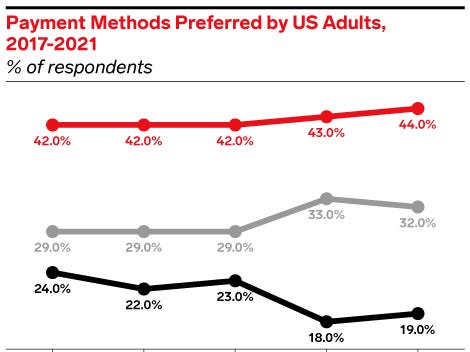

Consumer interest has been skewing toward digital alternatives, and cash is taking a major hit: Less than one-fifth (19.0%) of US adults cited cash as their preferred method for in-person spending in 2021, according to the Federal Reserve Banks. Younger consumers and fewer low-value purchases are driving the dissipation of cash. But even though cash usage is dwindling, the Federal Reserve reports that 79% of US adults still hold cash daily. It is suspected that the wide availability of ATMs, state requirements for stores to accept cash, and typical weekly purchases among Black and Hispanic adults will keep cash from completely fizzling out.

Along with cash, checks are trending downward: In October 2021, just 46% of US adults stated that they had used a check in the past 30 days, according to the Federal Reserve. Generally, consumers use checks for infrequent, high-value transactions. However, with the increasing availability of online bill pay and mobile peer-to-peer payment apps, digitization and convenience are hastening the check decline. Additionally, business transactions made with checks plummeted to 33.0% in North America last year due to a need for more efficient reconciliation, better fraud control, and cost savings, according to an Association for Financial Professionals survey.

Cash and check usage may be dwindling, but debit and credit cards are seeing upticks among economic uncertainty. With that being said, an estimated 82% of US adults have access to a debit card, per Pulse, making growth difficult. For credit cards, the risk lies in the ability for consumers to make minimum payments paired with less frequent high-ticket purchases as concerns about inflation and job security persist. In order to circumvent these risks and keep consumers spending, issuers are beefing up their rewards programs.

Another winner of the pandemic has been buy now, pay later (BNPL) as it combines the flexibility of credit with short repayment terms, app-based shopping, and a simple user experience. So long as consumers are struggling to make ends meet, merchant acceptance rates continue to increase, and new entrants improve accessibility, BNPL will keep growing and threatening the use of credit cards.

As consumers become more concerned about the economy and job security while also steadily adopting new digital solutions, we are seeing shifts away from traditional payment methods. Curious to learn more about the state of payment methods? Click here to purchase this report directly from Insider Intelligence. Looking for more data? Click here to purchase The Payments Ecosystem 2023 collection.